Private Equity is the most popular choice of funding

17 April 2018

BDO in the United Kingdom surveyed the technology companies in the UK in February 2018 and found that well over half (57%) of tech companies plan to raise external funding in 2018. Tech companies of all sizes are looking for new funds – particularly those with turnover up to £10m (73%).

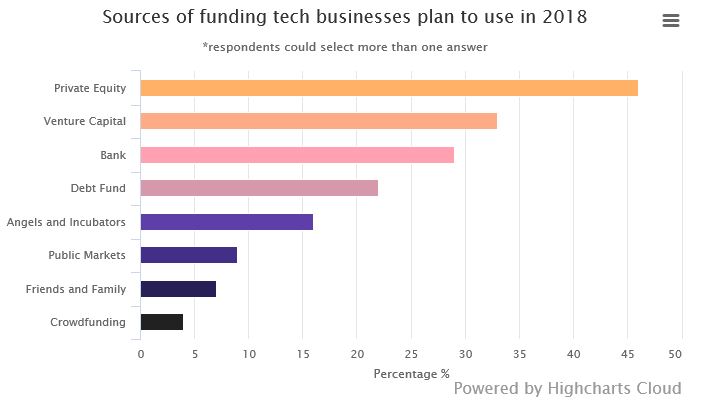

Across all tech companies, private equity (PE) is the most popular choice (sought by 46% of those seeking external funding), followed by venture capital (VC) (33%) and traditional bank funding (29%).

Based on our survey, PE funding has strong appeal across companies of all size. For example, 50% of fund seekers with turnover over £100m are looking for PE funding, as are 71% of fund seekers with turnover of £10m-£25m and 40% of the smallest fund seekers (turnover less than £2m). Such tech companies recognise that PE houses have big funds to access. The global private equity industry is thought to have around £1 trillion of “dry powder” – funds raised but not yet invested. These time-limited funds are looking for good investments, so there’s a lot of money chasing a small number of suitable businesses.

Tech companies are optimistic about their fund-raising potential. The majority (62%) don’t think their business is disadvantaged in raising funds compared to larger or smaller tech firms. The general buzz in the sector is that money is available and tech companies can achieve high valuations.

In comments, some tech companies refer to funding challenges arising due to specific circumstances – such as having a “mix of hardware and software” or an “unconventional” path that the investor community doesn’t fully understand. Some reveal a sense of frustration with the conservative and profit-focused attitude of some lenders. This suggests that, if PE and VC lenders do have cash burning their pockets, they might need to take a higher risk approach in order to find enough opportunities to back – an approach that is more established in the more mature US market.

Raising cash on the public markets is low on the list of preferred choices, an anticipated route for only 9% of tech companies seeking external funding. Many companies may be deterred by the increased public scrutiny and corporate governance hurdles that come with a public market presence, despite this, we do see global tech IPOs starting to gain traction in the months ahead.

Outlook #1: Tech IPOs make a comeback

Where the US market leads, the UK often follows. Following a lacklustre 2016, 2017 saw a slight uptick in US tech IPOs and there are hopes that 2018 will prove to be a far more buoyant year. Although tech companies find numerous reasons or excuses to stay private, there are many tech unicorns thought ready for the public spotlight. Dropbox filed to go public in February and “Decacorn” O2 is likely to be London’s biggest listing.

Please fill out the following form to access the download.