BDO USA has put together an overview of their tenth annual private equity perspective survey that concludes 76 PE firms in the US and internationally. This survey presents its readers with an insight into PE firms’ standpoint regarding current economic and political market situation, geographical and industrial investment decisions, digital transformation and many more subjects.

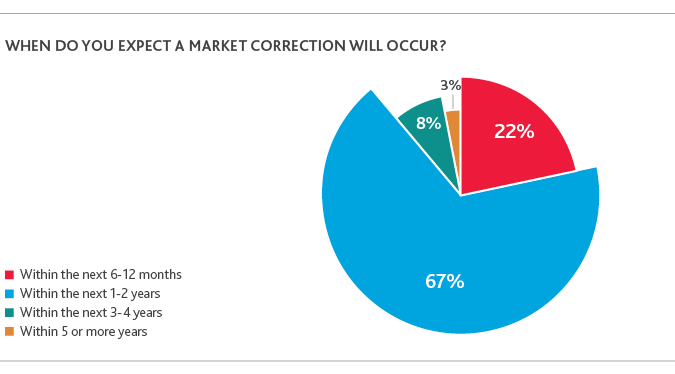

According to the survey, 89 percent of private equity fund managers expect a prolonged market downturn sometime in the next two years. Over one-fifth anticipate a market correction in the next 6-12 months. Meanwhile, more than two-thirds anticipate a market correction in the next 1-2 years.

“Data suggests that there’s a shift underway in private equity. Valuations are at historic highs, as heightened competition for a limited number of quality deals continues to drive up purchase prices. However, a confluence of economic factors leads us to believe a market correction may be coming. Expect valuations to be tested as buyers get less aggressive on cyclical assets.”

.jpg.aspx?lang=en-GB) Scott Hendon

Scott Hendon

National Private Equity Industry Group Leader, BDO

Whether the recession comes tomorrow or in two years, PE firms are proactively taking steps to support their portfolios for potential economic growth slowdown. Thereof, 70 percent of survey respondents are being more selective when evaluating highly valued deals.

.png.aspx)

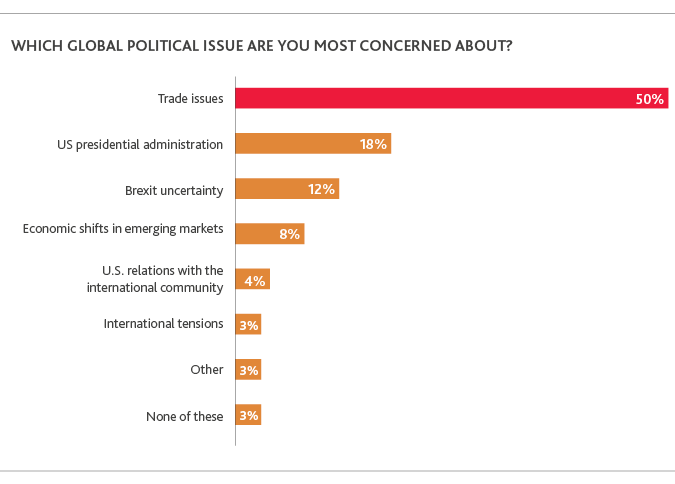

Although, US presidential administration and Brexit uncertainty are both issues to be worried about, the trade tensions have actually become the biggest concern among global political issues for private equity industry in 2019, making the predictability of future cash flows less certain.

“When it comes to tariffs, there are always winners and losers. The latest rounds of tariffs between the U.S. and China are increasing production costs, eroding margins, and raising prices for U.S. consumers. These “section 301” tariffs are impacting a range of goods from raw materials to electronics and machinery. Previously, prospective buyers paid comparatively less attention to a potential target’s spot in the overall supply chain and rarely considered the tariff impact of a potential transaction. Recent uncertainty around the future of U.S. trade policy has made prospective buyers wary of a target’s exposure to tariffs and the potential impact to margins and operations.”

Damon V. Pike

Damon V. Pike

Principal, International Tax – Customs & Int’l Trade, BDO

Founder-owner buyouts are likely to become more active in upcoming years as baby boomers continue to retire. The survey indicates that PE firms’ focus largely remains on new deals, which is consistent with prior years. Funding portfolio working capital needs, add-on acquisitions and de-leveraging portfolio company balance sheets are not a top priority compared to the hunt for new deals.

.png.aspx)

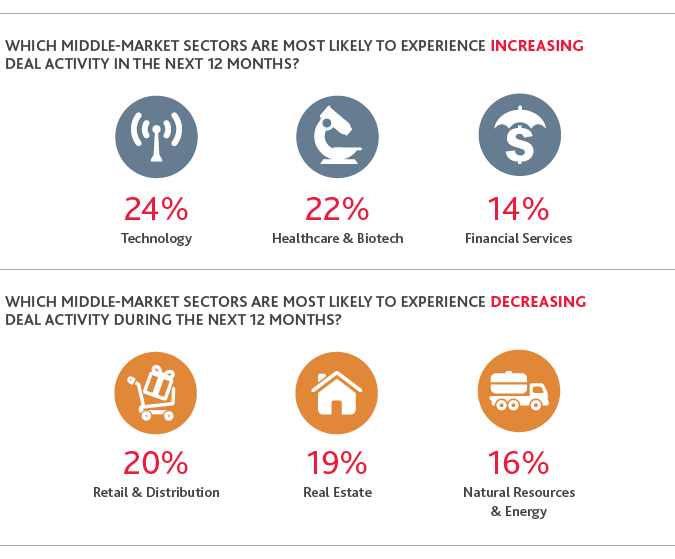

The activity within industry is expected to increase in technology, healthcare & biotech and financial services sector in 2019. On the other hand, retail & distribution, real estate and natural resources & energy are most likely to experience decreasing deal activity during the next 12 months.

“The rise of economic nationalism and populism around the world is shifting the dynamic for cross-border investments, data, and people. Changes to international trade policies are also starting to have a profound impact on private equity investments. Also, adding to this complexity, new U.S. regulations are changing how international entities are taxed.”

Lee Duran

Lee Duran

Tax Office Managing Partner, Japan Desk Leader, BDO

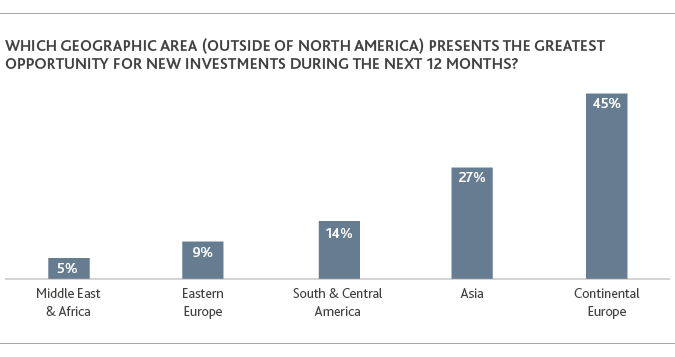

Continental Europe is expected to become the most attractive region for investments in this year. Asia might begin to fall out of favour due to geopolitical concerns. Though it is worth noting that a possible Brexit has led to a major decline in investors’ appetite for UK-dedicated funds in the last year.

For PE firms and their investment decisions, it is rather more important to see the digital potential within a target organization than the current level of digital maturity. Advancing technology not only presents us with opportunities but also with threats, which brings us to the discussion of cybersecurity that can affect the value of the company and that should be given a higher priority by potential buyers. Therefore, portfolio companies adaptation for a more digital future is crucial.