Record year of deals for BDO

12 February 2018

1,200 M&A transactions completed in 2017, worth US $ 54.5 Bn despite political uncertainty

The corporate finance teams at global accounting and advisory organisation BDO have had a record year of deals, completing over 1,200 transactions in 2017 with a combined value of more than USD 54.5 billion.

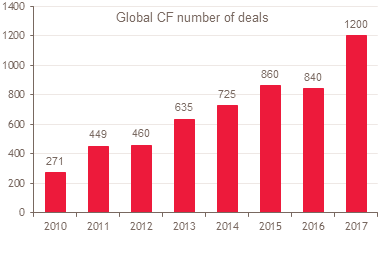

Deal volumes for BDO have grown by nearly 45% from 840 in 2016 to 1,200 in 2017, while deal value increased to USD 54.5 5bn in 2017 - a 50% increase on the USD 35.6 bn total last year.

BDO said transactions with private equity involvement also increased by nearly 60% from 212 deals (2016) to 334 (2017), with deal flow looking strong for 2018 as PE houses continue to deploy large funds in the market. A third of deals were cross-border transactions.

BDO’s Global M&A mandate growth since 2010

It is worth noting the particular achievements of the following BDO firms:

- United Kingdom - In the UK BDO ranks sixth in small-cap and is seventh for mid-market M&As

- Germany - BDO is now third in the German small-cap market and 4# in mid-market.

- Benelux –BDO firms in the Benelux area earn a combined third place in both mid-market and small-cap

- In Spain BDO achieved a fifth position in both mid-market and small-cap

- Nordics – BDO comes out number one M&A advisor, both in mid-market and small-cap

- Eastern Europe – M&A deals in Eastern Europe earn BDO firms in the region a sixth place in both small and mid-cap.

- Europe - M&A deals concluded in Europe see BDO take up a 3# position in the small-cap market, and 4# in the mid-market

Steffen Eube, Chair of the BDO Global Corporate Finance network: “We have had a great year across our transaction services and M&A teams. Our firms have made significant investments to grow our professional teams across the globe, and despite a year of political and economic uncertainties, our clients have trusted us to help them deliver their growth plans.”

The increase in volume and value has had a direct effect on BDO improving its position in industry league tables as a Top 4# worldwide M&A financial advisor in the Thomson Reuters 2017 rankings and as a Top 4# Due Diligence advisor in the Mergermarket 2017 rankings.