Accounting

Requirement to maintain accounting

All companies and branches of foreign companies operating in Estonia are subject to accounting requirements. The general principles of accounting are set out in the Estonian Accounting Act that provides legal bases and establishes requirements for organizing accounting and financial reporting pursuant to internationally recognized principles. The management board shall organize the accounting of the companies.

Financial reporting obligations

At the end of each financial year, an accounting entity is required to prepare an annual report according to the company size group requirements that are defined by the Accounting Act.

Commercial Register

Every company must prepare and submit an annual report to the Commercial Register.

Annual reports must be filed with the register even if the company had no transactions in the financial year.

If a company fails to submit the annual report, the registrar shall issue a warning on deletion from the register and obligate the company to submit the annual report within a specified term. If the company has failed to submit the annual report the registrar may delete the company from the commercial register according to the Commercial Code.

Deadline for filing

The approved annual report must be submitted to the Commercial Register within six months of the end of the financial year.

Reporting format

Unconsolidated annual reports prepared under Estonian GAAP are to be submitted electronically in XBRL format through Company Registration Portal

Other annual reports are to be submitted in pdf format. Since 2011, consolidated annual reports prepared under Estonian GAAP and annual reports prepared under IFRS can voluntarily be submitted in XBRL format.

The environment for submission of annual reports of the company registration portal of the Commercial Register enables persons to prepare reports according to forms provided by offering summarizing and controlling rules, to assign persons who can make entries, allows an auditor to create an electronic auditor’s report, and all authorized persons to sign a digital report.

Entries in the Commercial Register are public.

Reporting currency

The Annual financial statements shall be prepared using the currency officially applicable in Estonia.

Language of the annual report

Annual financial statements should be prepared in the Estonian language. However, the Accounting Act does not specifically limit the language in which everyday bookkeeping should be arranged.

Exceptions for branches of foreign companies

Branches of foreign companies need not prepare annual reports. Instead, an unattested copy of the audited and approved annual report of the company is submitted to the Commercial Register of the location of the branch no later than one month after approval of the annual report or seven months after the end of the financial year.

Financial year

A company’s financial year is 12 months long.

Financial years varying from the calendar year

A financial year generally coincides with the calendar year (1 January-31 December), but a company’s articles of association may specify a different financial year.

Exceptions to financial year concerning foundation and dissolution

When a company is established, dissolved, or the beginning date of the financial year changed, the financial year may in these exceptional cases be shorter or longer than 12 months, but not longer than 18 months.

Accounting principles

According to the Act, commercial undertakings may choose whether to prepare their annual financial statements according to Estonian Accounting Standards (Estonian GAAP) or IFRS. Listed companies, credit institutions and insurance companies are required to follow IFRS.

The Estonian Accounting Standards are issued by the Accounting Standards Board which acts under the supervision of the Ministry of Finance.

Estonian GAAP

Estonian GAAP effective from 2013 is based on IFRS for Small and Medium- sized Entities (IFRS for SMEs) with limited differences from IFRS for SMEs with regard to accounting policies as well as disclosure requirements.

Differences in accounting policies

Differences in accounting policies arise mainly due to the fact that in some areas Estonian GAAP allows a choice of accounting policy, one of the alternatives being the only policy accepted under IFRS for SMEs. In areas not specifically covered by Estonian GAAP, the treatment in IFRS for SMEs is recommended, but not mandatory. Each Estonian GAAP standard contains a brief comparison with the respective section of IFRS for SMEs.

Accrual-based accounting

Accounting for Estonian companies is based on the accrual method. In the case of accrual method, economic transactions will have to be recognized as they accrue, regardless of whether funds have been received or paid.

Chart of accounts and accounting policies and procedures

There is no compulsory chart of accounts under the current legislation. Each entity has to prepare its internal chart of accounts.

An accounting entity is required to set up accounting policies and procedures establishing the charting of accounts as well as a description of the contents of the accounts and which regulate, among other things, the documentation and recording of business transactions, the flow and preservation of source documents, the maintenance of accounting journals and ledgers, the presenting of revenue and expenditure under income statement items, and the physical inventory of assets and liabilities.

In addition, it regulates the accounting policy and presentation format used by the accounting entity, the procedure for preparing financial statements, the usage of accounting software, and the circumstances relating to the organization of accounting and the implementation of related internal audit measures.

Source documents

All economic transactions must be documented. The Accounting Act sets a number of formal requirements to accounting source documents.

Options for issuing invoices

Invoices may be divided into four types:

- a paper invoice handed over or sent by post by the seller to the buyer;

- e-mailed invoice (as an email attachment, e.g. a document in .pdf format, with or without a digital signature);

- an invoice exchanged by systems (e.g. a document in .xml format based on the standard of Estonian e-invoice).

- an e-invoice is thus one of the possible forms of invoices. An e-invoice is an electronic document, which is created, transmitted, recorded and stored in an electronic environment, i.e. a document which is handled electronically from the beginning till the end. Requirements for the content of the invoice are independent from the form of the invoice, i.e. requirements for paper invoices also apply to electronic invoices.

Consolidated financial statements

Consolidated group parent companies have the responsibility to prepare consolidated financial statements. Consolidation means joining of the financial statements of different accounting entities in order to provide a united annual report as if companies in question were one single entity.

Estonian legislation defines consolidating entity as a parent undertaking or any other accounting entity exercising dominant influence over another accounting entity (consolidated entity). Following are examples of often occurring dominant influence:

- A holding of more than 50% of the voting rights belonging to the consolidated entity;

- A right arising from law or a contract to appoint or remove a majority of the members of the management or the highest supervisory body (usually on account rights of general meeting or a founder).

The reports of the consolidation group’s parent company are filed as notes to the consolidated financial statements.

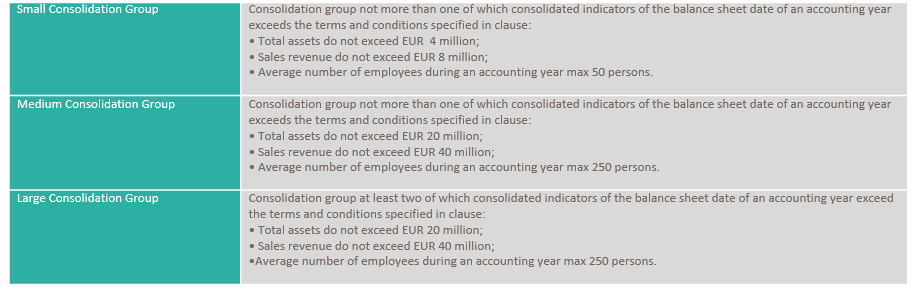

Consolidation groups

Requirements to consolidated financial statements

Medium and Large Consolidation Group is required to prepare full consolidated financial statements in accordance with Estonian GAAP or IFRS.

Exceptions