Labour market rules & social security

Employment contracts

Throughout the period of employment, the employee works individually and receives a monthly fee for the whole working period. Employment contract is regulated mainly by the Employment Contracts Act and the Law of Obligations Act, but also by other regulations. For example, a motor vehicle drivers's work and rest time are regulated by the Road Traffic Act and abord ships, crew members' working time is governed by the Seafarers Act.

Other benefits

There are also different other sickness benefits which are paid directly by Health Insurance Fund.

(Private insurance)

Health insurance ensures primary medical care, but health insurance policies from private insurer can provide coverage for expenses related to unforseen illness abroad, accident or other unanticipated circumstances, such as:

- emergency medical care and hospital expenses (state and private), medications

- expenses on transporting and repatriating patients

- lodging and living expenses for person accompanying the insured

- in the case of fatality, repatriation of the deceased to Estonia or funeral expenses abroad

Use of the Health Insurance Fund card in Europe

Those insured by the Estonian Health Insurance Fund who are temorarily staying in European Union Member State receive the medical care they need on equal footing with insured persons who reside in that country. The need for medical care must have arisen at the time that the person was present on foreign soil. To receive medical care, you must present, at a health care institution, the European health insurance card or or relevant certificate and an identity document.

Employer's responsibilities

An employer's primary responsibility in labour realtions is to provide employees with the specified work and pay wages in exchange for it, while an employee's primary responsibility is to perform work for employer, while the employee is under the employer's maganement and control.

Empoyment relationships over 2 weeks in duration require a written employment contract

The employment contract is generally concluded in writing and contains certain mandatory terms, such as information about the parties, the employee's job title, the nature of assignments, working time, length of annual vacation, work location, wage condition.

Oral employment contracts

An oral employment contract may be entered into only for employment for a term of less than two weeks.

Terms of employment contracts

Usually employment contracts are entered into for an unspecified period. With the agreement of both parties, such contracts can be entered into for a specified period (but no longer than five years). However, the employer must be able to justify the temporary nature of work (short-term increase in workload or seasonal work for example).

Probationary period. A period up to 4 months may be specified.

An employment contract prescribes a probationary period in order to confirm that employee has the necessary health, abilities, suitable social skills to perform the work agreed on in the employment contract.

Every working relationship is subject to a 4-month probationary period, which could be shortened or skipped when agreed so between parties (in writing). If no such agreement exists, the 4-month probationary period is automatically implemented. In the cace of an employment contract entered into for a specified period up to 8 moths, the probationary period cannot be longer than half of the duration of the contract. For example, in the case of a 6-month contract the probationary period cannot exceed 3 months.

Alternative contracts

Basic principles of the Law of Obligations Act in regard to entering into contracts

- AUTHORISATION AGREEMENT (KÄSUNDUSLEPING) One person undertakes to provide services to another person according to an agreement for remuneration if so agreed.

- CONTRACT FOR SERVICES (TÖÖVÕTULEPING) One person undertakes to manufacture or modify a thing or to achieve any other agreed result by providing a services (work) to the other person for remuneration if so agreed.

- AGENCY CONTRACT (AGENDILEPING) One person undertakes, in the interests of and for the benefit of another person, to negotiate or enter into contracts in the name and on account of another person independently and on a permanent basis remuneration of so agreed.

All of the contracts are regulated by the Law of Obligations Act (Võlaõigusseadus). Compared to the employment contract these contracts do not give as much protection to the employee. However, the person has more freedom to organize their own time as they are not under management and control of the employer. Additional incentives could be agreed in writing as well.

Find out more about employment income taxes in Individual taxation section.

Wage, payslips

Payment of wages once a month

Wages are the amount of money employees are paid for doing work as agreed between employees and employers. Empoyers must pay the employees' wages at leats once a month. If the pay day falls on a public holiday or day off, the wages must be paid on the preceding working day. Wages are paid as a net amount, with the employer deducting the employee's taxes from the agreed wages. Upon request the employer is obligated to provide the empoyee with information about the wages calculated and paid or payable to the employee (payslips).

Average wage

Varies according to sector. Accoring to the Statistics Estonia the average wage is approximately 1146 EUR (data: 2016).

Minimum wage

Employees cannot payd less than the minimum wage stipulated by the Government of the Republic. For 2017, the legally established minimum wage is 470 EUR (gross amount).

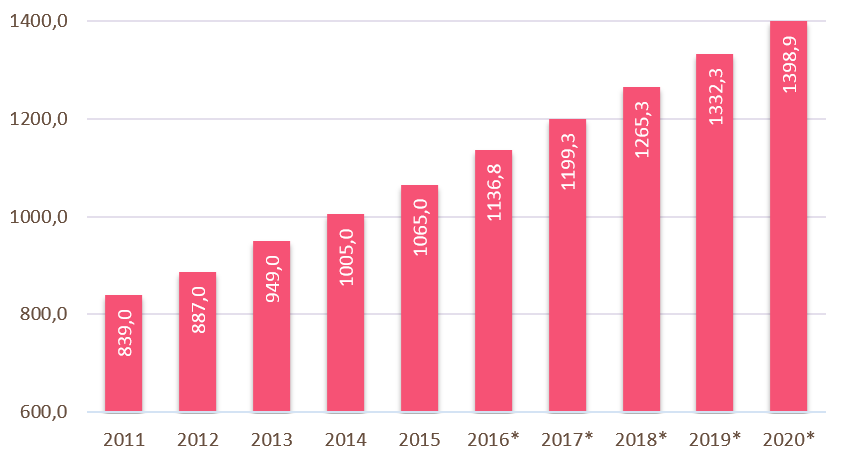

Average monthly gross wages and salaries (EUR)

*forecast of Ministry of Finance of Estonia

Source: Ministry of Finance of the Republic of Estonia (Forecast of Summer 2016, as of 15.09.2016)

Find out more about taxes on workforce in Tax system section.

Working time, public holidays

Working time

Full-time working time is 8 hours per day, 5 days per week. An employer and employee can agree on shorter working hours (part-time work). Minors have shorter working time.

Overtime

Overtime is usually permitted by agreement between the employer and employee. However, the total working time shall not exceed on average 48 hours within a period of seven days over a calculation period of up to four months, unless a different calculation period has been provided by law.

Night work

Between 10 pm and 6 pm.

Public holidays

There are 9 national and public holidays in Estonia with days off.

These are:

- 1 January - New Years's Day

- 24 February - Independence Day

- 14 April - Good Friday

- 1 May - May Day

- 23 June - Victory Day

- 24 June - Midsummer Day

- 20 August - Re-Independence Day

- 24 December - Christmas Eve

- 25 December - Christmas Day

- 26 December - Boxing Day

Work on public holidays has to be compensated at a double rate.

Compared to Lativa, Lithuania, Finland.

Shortened work days

The working days before New Year's Day (1 January), the anniversary of the Republic of Estonia (24 February), Victory Day (23 June) and Christmas Eve (24 December) are three hours shorter.

Leave and holiday / Annual holiday is 28 days

The duration of an annual holiday shall be specified in an employment contract and it is presumed that an employees' annual holiday is 28 calendar days unless the employee and the employer have agreed on a longer annual holiday or unless otherwise provided by law (minors, pedagogical specialists, etc.). The annual holiday of an employee who works part-time shall be of the same duration as the annual holiday of a full-time employee. Employers shall pay employees holiday pay for annual holiday.

Additional holiday

According to the Employment Contracts Act there are also different adiitional holidays possible in specific circumstances: pregnancy and maternity leave, paternity leave, adoptive parent leave, child care leave, child leave, child leave without pay and study leave.

Payment of wages for overtime

FREE TIME or 1.5 times the rate of employee normal wage

Payment of wages for night work

FREE TIME or 1.5 times the rate of employee normal wage.

The parties may agree that the employee's wages will include a fee for working at night.

If the employee receives the minimum wage, it does not include a fee for working at night.

Payment of wages for work done on public holidays

FREE TIME or 2 times the rate of employee normal wage.

Termination of employment contract

Employment Contracts Act

Bases for the termination of an employment contract are provided in the Employment Contract Act.

Termination of employment contract by mututal agreement

An employment contract may be terminated upon agreement between the parties at any time.

Cancellation of employment contract on ordinary grounds. The grounds for cancellation of employment contract are clearly defined.

An employee may ordinarily cancel an employment contract entered into for an uspecified term at any time. An employer may not cancel an employment contract ordinarily.

Term of advance notice

An emploment contract may be cancelled during a probationary period by giving no less than 15 calenda days' advance notice thereof. An employee shall notify the employer of ordinary cancellation no less than 30 calendar days in advance. An employer shall give an employee advance notice of extraordinary cancellation if the employee's employment relationship with the employer has lasted:

- less than one year of employment - no less than 15 calendar days;

- on to five years of employment - no less than 30 calendar days;

- five to ten years of employment - no less than 60 calendar days;

- ten and more years of employment - no less than 90 calendar days

Extraordinary cancellation of employment contract

An employer may extraordinarily cancel an employment contract if the continuance of the employment relationship on the agreed conditiond becomes impossible due to a decrease in the work volume or reorganisation of work or other cessation of work (layoff for economic reasons). More info in Employment Contracts Acr §79, § 85, §96-98, §89 p.1, § 89 p.2, §100)

Layoffs

Layoff is also extraordinary cancellation of an employment contract:

- upon cessation of the activities of employer;

- upon declaration of bankruptcy of employer or termination of bankruptcy proceedings, without declaring bankruptcy, by abatement.

Upon cancellation of an employment contract due to layoff, an employer shall pay the employee compensation to the extent of one month's average wages of the employee and other compensations set by the law. (If needed by the employee, the employer should issue two certificates for the employee - employer's certificate for the insured person (tööandja tõend kindlustatule) and employer's application for redundancy benefit (tööandja avaldus koondamishüvitise saamiseks)).

Labour Dispute Committee

The labour dispute committee is a pre-judical, independent body that resolves individual labour disputes. Either the employer or employee can turn to the committee without the need to pay a state fee. The committee is empowered to resolve all disputes arising from employment relationsships. When contacting the committee, it should be considered that the committee resolves monetary claims up to 10,000 euros. Courts are empowered to resolve disputes involving more than that sum.

Unions

The Estonian Trade Union Confederation (EAKL) is comprised of 20 branch unions represent:

- state and municipal government officials,

- education workers,

- health care workers,

- transport workers (including road, railway, sea and air transport),

- industrial workers (including energy, light industry, food industry, timber and metal industry),

- people employed in the service sevtor (postal, communication, trade, hotel and cleaning sector workers etc.).

The EAKL operates to enusre that the principle of social justice is respected in society.

Foreign employees

Legislation on employment of foreigners

Estonia is taking steps to ease rules on hiring foreign nationals.

Free movement of labour

Citizens of the European Union, European Economic Area and the Swiss Confederation (hereafter referred to as citizens of the European Union) do not need a separate permit to work in Estonia. In order to obtain a residence permit they must register their place of residence with the appropriate local government agency within three months of arriving in Estonia. Temporary residence permits are issued for periods of up to five years. See for more on Ministry of Social Affairs web.

Work permits

All people who are not citizens of the European Union (hereafter referred to as foreigners) need a work permit to work in Estonia with the exeption of:

- foreigners who have a long-term permit resident's permit;

- foreigners who have a residence permit for the purpose of employment;

- foreigners who applied for a residence permit prior to 12 July 1995 and who were issued with a residence permit;

- prisoners while in prison;

- members of locomotive crews;

- members of staff serving locomotives or trains;

- drivers transporting passengers or goods across the national border;

- foreigners who have a residence permit for the purpose of taking up residency with a family member who lives in Estonia permanetly;

- foreigners who have a residence permit for the purpose of taking up residency with a spouse;

- foreigners issued with a residence permit on the basis of an international agreement.

Citizenship and Migration Board

Applications for work permits must generally be submitted to the regional departments of the Citizenship and Migration Board.

Proof of residency

Residence permits for the purpose of employment are issued to foreigners for work with an employer registered in Estonia.

In certain cases foreigners may work in Estonia for short periods of time (up to 6 months) without a work permit. Such employment must still be registered with the Police and Border Guard Board.

Members of management and supervisory bodies

A foreigner may work in Estonia as a member of the management body of a legal entity registered in Estonia in order to fulfil management and supervision functions for up to six months in a year without a work permit or a residence permit and without being registered with the Police and Border Guard Boards if they have a legal basis for residing in Estonia.

Non-residents

Resident and non-resident concept and taxation:

A natural person is a resident if one of the following conditions is met:

- his or her place of residence is in Estonia;

- he or she stays in Estonia for at least 183 days over the course of a period of 12 consecutive calendar months. A person shall be deemed to be a resident as of the date of his or her arrival in Estonia;

- Estonian diplomats who are in foreign services are also Estonian residents.

If these are not met, a natural person is non-resident. Please find more information on Tax and Customs Board website.

Taxation of non-residents

Non-residents have a limited tax liability in Estonia; their taxable income consists only from Estonian sources. Non-residents may not claim the same deductions and allowances as avaiable to residents.

Look for examples of tax calculations for wages of resident and non-resident employee in Individual taxation section.

Management board members

A number of conventional Employment Contract Act provisions do not apply to management board members.

Management Board Member agreement is a legal agreement regulated by the Law of Obligations Act (authorisation agreement). The authosisation agreement does not regulate annual holiday, but it is possible to add it in written if agreed.

Health insurance for management board members

There are also fidderences in the health insurance as for the member of the management it will start not until three months after registration and only then when the minimum rate of the social security tax is paid from the remuneration. According to that in 2017 the minimum remuneration for the member of the management should be at least 470 EUR in order to ensure the health insurance.

Unemployment insurance for the management board members

From the remuneration of member of the management unemployment insurance taxes are not withheld (neither employer's nor employee's contribution).

Sickness benefit paid by employer

Registration in Estonian Health Insurance Fund

Social and health insurance

An insured person is a permanent resident of the Republic of Estonia or a person living in Estonia by virtue of temporary residence permit or by the right of premanent residence, who pays the social tax for himself/herself or for whom the payer of social tax is required to pay social tax.

The payment of illness benefits is shared between state and employer.

Registration with the Health Insurance Fund

It is the employer's obligation to register new employee in health insurance database as soon as possible after concluding the contract. It is also the employes's obligation to send employees' sick-leave documents to the Health Insurance Fund. An employee who is entitled to health insurance must be registered with the portal eesti.ee The portal can also be sent via electronic sick notes.

Sickness benefits

In case of an illness, quarantine, household or traffic injury and somplications and illnesses caused by traffic injuries, no sickness benefit is received for the first three days. For days 4 to 8, benefit is paid by the employer, starting from day 9, the Health Insurance Fund. The benefit rate is 7+& of the day wages, calculated by the employer vased on the average wage in the last six months and by the Health Insurance Fund based on social tax payments during the last calendar year.

Other benefits

There are also different other sickness benefits which are paid directly by Health Insurance Fund. More information.

(Private insurance)

Health insurance ensures primary medical care, but helath insurance policies from a private insurer can provide coverage for expenses realtes to unforeseen illness abroad, accident or other unanticipated circumstances, such as:

- emergency medical care and hospital expenses (state and provate), medications

- expenses on transporting and repatriating patients

- lodging and living expenses for persons accompanying in the insured

- in the case of fatality, repatriation of the deceased to Estonia or funeral expenses abroad

Use of the Health Insurance Fund card in Europe

Those insured by the Estonian Health Insurance Fund who are temporarily staying in a European Union Member State receive the medical care they need on equal footing with insured persons who reside in that country. The need for medical care must have arisen at the time that person was present on foreign soil. To receive medical care, you must present, at a health care institution, the European health insurance card or relevant certificate and an identity document.

Business trips

An employer may send an employee outside the place of performance or work prescribed by the employemnt contract in order to perform duties. An employee may not be sent on a business trip for longer than 30 consecutive calendar days, unless the employer and the employee have agreed on a longer term.

Special circumstances with regard to business trips

A pregnant woman and a employee raising a child under three years of age or a disabled child may be sent on a business trip only with his or her concent. An employee who is a minor may be sent on a business trip only with the prior concent of the minor and his or her representative.

Per diems

It is possible to send to the business trip and pay the tax free daily allowance to:

- employees (business trip),

- public servants (official travel),

- members of the suvervisory and management board (official journey),

- creative persons (creative person posting),

- athletes, coaches, judges, etc. (sports assignments).

Per diems for domestic business trips

There is no option for paying tax-free daily allowances on business trips within Estonia.

Per diems for foreign business trips

The regulations on foreign business trips are flexible.

According to the law during the business trip outside Estonia, minimum daily allowance rate is 22,37 EUR. Maximum daily allowance rate is 50 EUR (tax-free, might be higher but then it is taxed as a fringe benefit). Daily allowance is paid when the destination of the job is at least 50km from the settlement where the usual employment location is. The employer may reduce the rate subsistence allowance of up to 70% when free meals are ensured during the business trip.

Special circumstances regarding payment of daily allowances

Tax-free daily allowance cannot be paid to self-employed persons and "employees" working with the contracts regulated by Law of Obligations Act (except the members of the management and supervisory board).

Accomodation expenses on business trips

No limit on accomodation expenses during business trips.

Other expenses on business trips

Other expenses related to business trips are tax-deductible if it can be substantiated that they were business expenses.