Founding a company

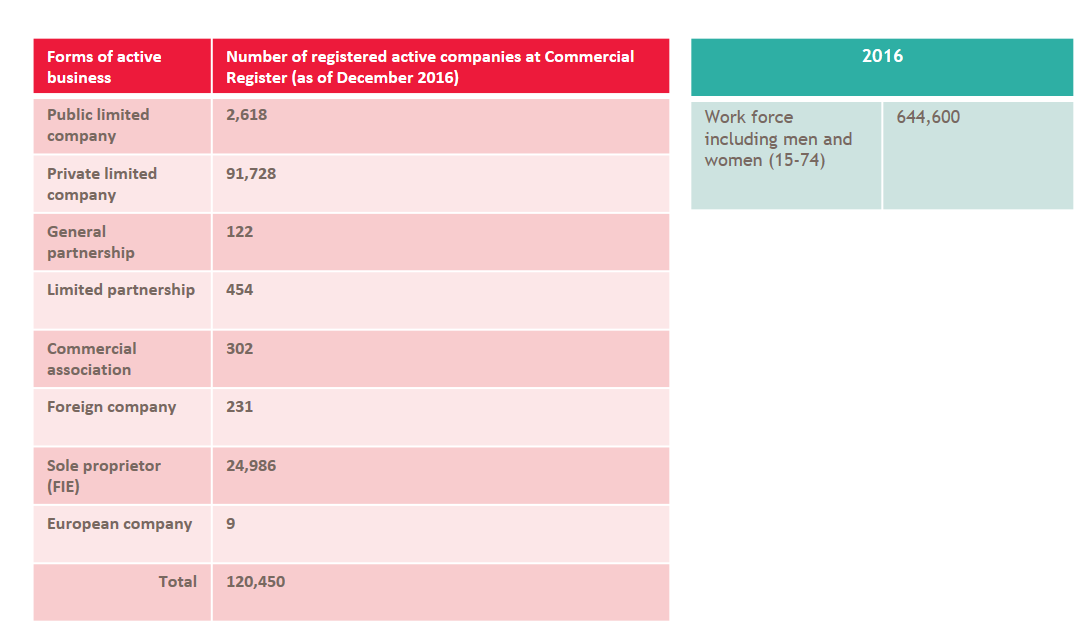

Forms of business in Estonia

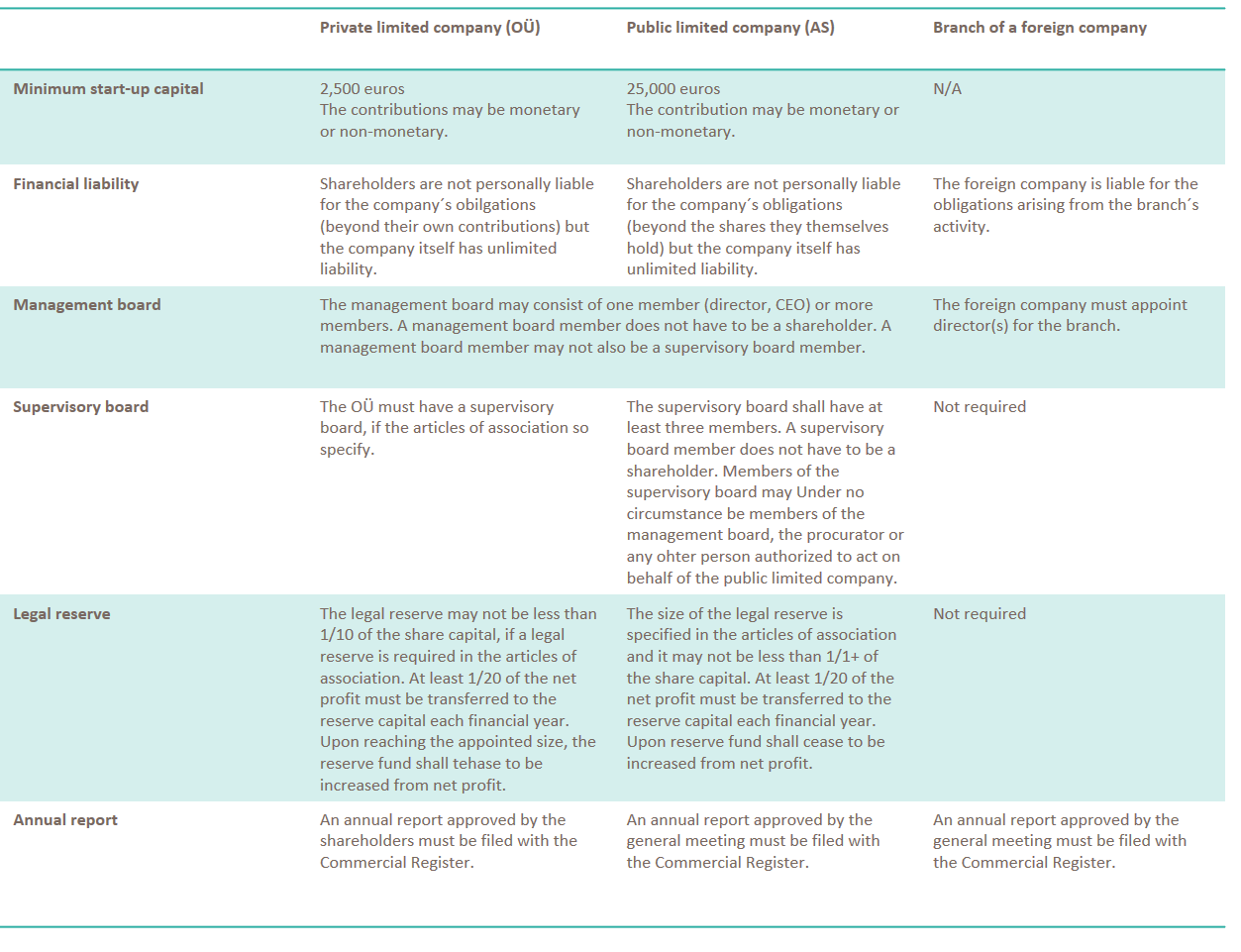

There are two main forms on limited liability companies in Estonia - AS and OÜ

Public limited company ( Estonian: aktsiaselts, AS)

A company that has its share capital divided into shares. Public limited companies are required to register their shares with the Central Register of Securities. The general meeting of shareholders is the public limited company’s supreme management body

Private limited company (Estonian: osaühing, OÜ)

A company that has its capital divided into shares held by partners. Each partner can hold one share. If a partner acquires an additional share, the nominal value of the original one increases. Registration of shares with the Central Register of Securities is optional for an OÜ.

As of 1 January 2011, a private limited company may be established without making a contribution to share capital, if the company’s future area of activity does not require capital to be placed. The share capital of such a company is comprised of claims against the shareholders, whose liability for the contributions not actually made by them is equal to the amount they pledge to contribute.

There is an average of one OÜ for every 5 inhabitants of working age.

Source: Statistics Estonia (as of end 2016)

In addition to two above mentioned, there are also other forms of business in Estonia. To know more precisly which would fit you, we advise to contact our specialists.

Some of the more common options would be:

Branch of a foreign company

If a foreign company wants to offer goods or services in Estonia on a permanent basis, it must register a branch with the Commercial Register. A branch is not a legal person. That means the company is liable for the obligations arising from the branch’s activity. The branch of a foreign company is registered in the Commercial Register on the basis of request by the branch director. The foreign branch must maintain separate accounting.

Sole proprietor (FIE)

Any individual may be a sole proprietor, but before beginning operations, he or she must first apply for registration with the Commercial Register. A FIE has unlimited liability for financial obligations. This is a common form of enterprise among individuals who do smaller amounts of business.