Corporate taxation

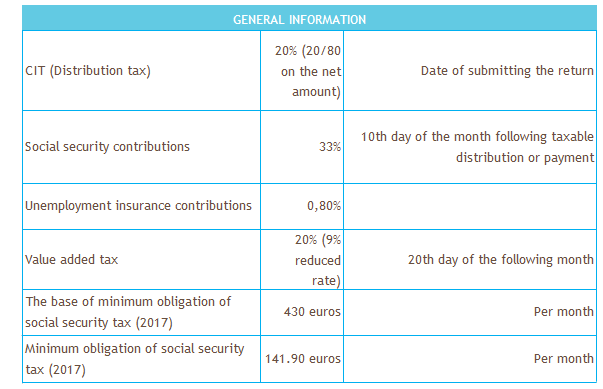

Tax rates from the homepage of Tax and Customs Board.

Corporate profits are subject to income tax upon distribution, the most common form of whist is dividend. Certain payments as fringe benefits, gifts, donations, costs of entertaining guests, expenses and payments not related to business are also identified as profit distributions for income tax purposes. Retained profits therefore enjoy deferred taxation which is considered most attractive tax incentive for companies to invest in Estonia.

Residence

A legal person is a resident if it is established pursuant to Estonian law. European public limited companies (SE) and European associations (SCE) whose seat is registered in Estonia are also residents.

Taxable income

Resident companies are taxable on their worldwide income. Given the way of how corporate profits are taxed (see General Information) the categorization of income is not important for income tax purposes.

Deductions

All certified expenses incurred by a taxpayer in relation to business during a period of taxation may be deducted from the taxpayer's business income. Expenses are related to business if they have been incurred for the purposes of deriving income from taxable business or are necessary or appropriate for maintaining or developing such business and the relationship of the expenses with business is clearly justified.

Income tax is not charged on business gifts, gifts and donations to specified non-profit associations and costs of entertaining guests not exceeding limits set by law.

Losses

There are no rules regulating of how losses can be carried forward because only distributed profits are subject to income tax.

Tax rate

Flat tax rate is 20%. Given that income tax is imposed on net distributions tax rate of 20/80 is applied (net distribution is grossed up first and then subject to tax rate of 20%).

Withholding taxes

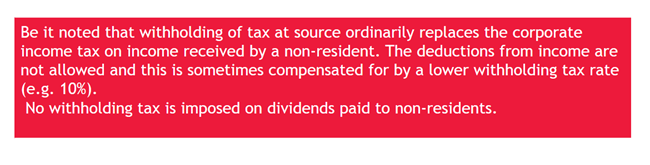

There are no withholding taxes on payments to resident companies. Tax treatment of payments to non-residents is dealt in section Withholding taxes on payments to non-residents.

Tax incentives

There are no other noteworthy tax incentives introduced in Estonia except deferred taxation of corporate profits.

Taxable period

Resident legal person and non-resident legal person which has a permanent establishment in Estonia are required to submit a tax return regarding the taxable distributions concerning the previous calendar month to the Tax and Customs Board by the 10th day of the calendar month following the period of taxation.

Payment of tax

A taxpayer is required to transfer the income tax to the bank account of the Tax and Customs Board not later than by the 10th day of the calendar month following the period of taxation.

Advance rulings

For an advance ruling, see section Tax administration.

Group treatment

Neither consolidation for tax purposes nor group contributions between affiliated companies are allowed in Estonia.

Intra-group dividends

A resident company shall pay income tax on profit distributed as dividends or other profit distributions upon payment thereof in monetary or non-monetary form. Income tax is not charged on profit distributed by way of a bonus issue.

The income tax is not charged on dividends if:

1) the resident company paying the dividend has derived the dividend which is the basis for the payment from a resident company of a Contracting State or the Swiss Confederation subject to income tax (except for companies located within a low tax rate territory) and at least 10 per cent of such company's shares or votes belonged to the company at the time of deriving the dividend;

2) the dividend is paid out of profit attributed to a resident company's permanent establishment located in a Contracting State or Swiss Confederation;

3) the company paying the dividend has derived the dividend which is the basis for payment from a company of a foreign state not specified in clause (1) (except for a company located within a low tax rate territory) and at the time of deriving the dividend, the company owned at least 10 per cent of the shares or votes of such company, and income tax has been withheld from the dividend or income tax has been charged on the share of profit which is the basis thereof;

4) the dividend is paid out of the profit attributed to foreign permanent establishment of a resident company and income tax has been charged on such profit.

A resident company shall pay income tax on the portion of payments made from the equity upon reduction of the share capital or contributions, upon redemption or return of shares or contributions or in other cases, and on the portion of the paid liquidation distributions which exceed the monetary and non-monetary contributions paid into the equity of the company.

Other taxes on income

No other corporate income taxes are levied.

Social security contributions

Social tax at the rate of 33% of the gross payment shall be paid by the employers:

1) on wages and other remuneration paid to employees in money;

2) on remuneration paid to members of the management or controlling bodies of legal persons;

3) on the business income of sole proprietors, after deductions relating to enterprise and permitted in the Income Tax Act have been made, but annually on an amount not more than 15 times the sum of the minimum monthly wages for the taxable period;

4) on remuneration paid to natural persons on the basis of contracts for services, authorisation agreements or contracts under the law of obligations entered into for the provision of other services unless the recipient is the sole proprietor and the income is the business income;

5) on fringe benefits within the meaning of the Income Tax Act, expressed in monetary terms, and on income tax payable on fringe benefits.

The upper ceiling of social tax is set only for sole proprietors. Social tax shall be paid on the remuneration paid to employees for a particular month, but on an amount not less than 430 euros (the amount applies to the year 2017).

The taxable period for social tax is one calendar month. The taxable period for social tax on the business income of a sole proprietor is one calendar year.

Unemployment insurance premium

An unemployment insurance premium shall be paid on wages, salaries and other remuneration paid to insured persons according to the rate of unemployment insurance premium established for the insured persons and employers.

The rate of unemployment insurance premium for employers is 0,8%. The taxable period for unemployment insurance premium is one calendar month.

Following persons are excluded from the list of insured persons:

1) a sole proprietor;

2) a member of the management or controlling body of a legal person.

Land tax

The rate of land tax shall be 0.1-2.5 per cent of the taxable value of land annually.

Unilateral double taxation relief

Relief from double taxation is ordinarily given in the form of a foreign tax credit. The income tax of a foreign state may be deducted only in the amount which it is mandatory to pay pursuant to the law of the state or an international agreement. Income tax paid in each state shall be recorded separately. Income tax paid in a foreign state on the income which is exempt in Estonia shall not be taken into account. No limitation period for carry-forward of unused tax credits has been set.

Tax treaty relief

Under most tax treaties concluded by Estonia, double taxation is eliminated by way of credit method. Sometimes different methods (exemption versus credit) are applied to different types of income.

Non-resident

A non-resident is a natural or legal person not considered resident (negative definition). A non-resident shall pay income tax only on income derived from Estonian sources (limited tax liability). Unless otherwise prescribed, the income of a non-resident legal person shall be declared and income tax shall be imposed, withheld and paid pursuant to the same conditions and procedure as in the case of a non-resident natural person. The income of foreign associations of persons or pools of assets without the status of a legal person is subject to taxation as the income of the shareholders or members of such association or pool in proportion to the sizes of their holdings.

Permanent establishment (definition by domestic law)

Permanent establishment means a business entity through which the permanent economic activity of a non-resident is carried out in Estonia. A permanent establishment is created as a result of economic activity which is geographically enclosed or has mobile nature, or as a result of economic activity conducted in Estonia through a representative authorised to enter into contracts on behalf of the non-resident.

When a non-resident carries on business in Estonia through a permanent establishment situated in Estonia, the income which the permanent establishment might be expected to derive if it were a distinct and separate taxpayer engaged in the same or similar activities under the same or similar conditions and dealing wholly independently of the non-resident of which it is a permanent establishment shall be attributed to the permanent establishment.

Estonian sourced income

Income tax is charged on business income derived by a non-resident in Estonia. If the non-resident is a legal person located in a low tax rate territory, income tax is charged on all income derived by the non-resident from the provision of services to Estonian residents, irrespective of where the services were provided or used.

Be it noted that in a tax treaty situation the taxation of business income requires the existence of a permanent establishment.

Capital gains

Income tax is charged on gains derived by a non-resident from a transfer of property if:

1) the sold or exchanged immovable is located in Estonia, or

2) the movable subject to entry in a register was in an Estonian register prior to the transfer, or

3) the transferred real right or right of claim is related to an immovable or a structure as a movable, which is located in Estonia, or

5) the transferred holding is a holding in a company, contractual investment fund or other pool of assets of whose property, at the time of the transfer or during a period within two years before transfer, more than 50 per cent was directly or indirectly made up of immovables or structures as movables located in Estonia and in which the non-resident had a holding of at least 10 per cent at the time of transfer.

Withholding taxes on payments to non-residents

Income tax is withheld from:

1) interest payment subject to income tax paid to a non-resident in relation to his share in a contractual investment fund of whose property, at the time of the transfer or during a period within two years before transfer, more than 50 per cent was directly or indirectly made up of immovables or structures as movables located in Estonia and in which the non-resident had a holding of at least 10 per cent at the time of transfer;

2) rent from a commercial or residential lease or payment for encumbering a thing with limited real rights paid to a non-resident;

3) royalties paid to a non-resident;

4) payments to a non-resident for services provided in Estonia;

5) payments to a legal person located in a low tax rate territory for services provided to an Estonian resident.

General anti-avoidance rule

For a general anti-avoidance, see section Tax administration.

Transfer pricing

If the price of a transaction concluded between a resident legal person and a person associated with the resident legal person differs from the market value of the above transaction, income tax shall be imposed on the amount which the taxpayer would have received as income or the amount which the taxpayer would not have incurred as expenses if the transfer price had confirmed to the market value of the transaction.

Deductibility of interest expenses

No thin capitalisation rules or other limitations on deductibility of interests have been introduced in Estonia. Only general transfer pricing principles are applied.

Controlled foreign companies (CFC)

Estonia has not introduced CFC rules for corporate taxpayers.